Putin’s War Economy Reaches Limit

The budget is perhaps the most important state document for the economy and for the entire life of the country. Its expenditure accounts for approximately 20% of GDP, so you can understand a lot by “following the money.”

The budgets of the war years had been formed using a simple principle, articulated by Finance Minister Anton Siluanov in late 2023 as “budgets of victory.” Every year, an increase in spending (primarily defence) would be planned. But the war would require more and more money. Rejections wouldn’t be accepted, expenditures would exceed the plan, and the Ministry of Finance would dip into the “piggy bank” and borrow the missing amount from state banks.

The first wake-up call came a year ago, when instead of cutting military spending (as planned), the government increased it again. To do this, it had to raise the corporate income taxes and introduce a progressive scale for the personal income tax. Moreover, that was when the economy began to slow down (and this year, it has drastically stalled).

It became clear that things couldn't go on this way anymore: the “victory budgets” would no longer be balanced. It was necessary to either stop the growth of spending—not in words, but in deeds—or raise taxes again, even though both Siluanov and Putin had promised not to do so until 2030. “This is not just some ordinary budget. It is a choice [of policy],” said Oleg Buklemishev, director of the Center for Economic Policy Research at the Moscow State University Faculty of Economics.

Military spending at maximum

The big news is, the (projected) military spending will not increase. In June, Putin argued that it was too high and assumed it could be reduced, but there was no certainty about this.

In years 2019 to 2021, Russia would spend 3 to 3.6 trillion rubles on the army, which is about 15% of budget expenditures. Since the war began, the so-called “national defense” expenditures have quadrupled, and their share of the budget has more than doubled. In the 2025 budget, the government planned to spend 13.5 trillion rubles, or 32% of all expenditures, on war. In 2026, spending on the army and the military industrial complex is planned to be lower by 0.6 trillion, at 12.9 trillion rubles. This is 4.4% lower than this year, but, given the rising prices, it will actually be 10% lower (it will depend on the average inflation rate).

Although the actual budget execution may be different from the government draft, for now we’ll be using the information we have. In 2027 and 2028, military and defense industry spending is expected to remain at roughly the same level (13-13.6 trillion rubles).

Cutting the “national defense” spending does not mean that the “hawks” in Putin’s circle have lost. Spending on other siloviks – national security and law enforcement – is simultaneously planned to increase from 3.5 to 3.9 trillion rubles . Total spending on the army, law enforcement agencies and security services will remain at almost the same (extremely high) level as in 2025 and will amount to 16.8 trillion rubles, while their share of budget expenditure will only decrease from 40% to 38%.

The reason the government has stopped increasing war expenditures is not because it does not want to increase them, but because it can no longer afford to do so. In May, economist Vladislav Inozemtsev was willing to bet that military spending had reached its maximum and would not grow any further. He said that Russia would be able to afford such [war] spending for a long time, but “if Putin wants to spend 20 trillion rubles next year, everything will go downhill.” In fact, it has already started to.

Revenues plummeted

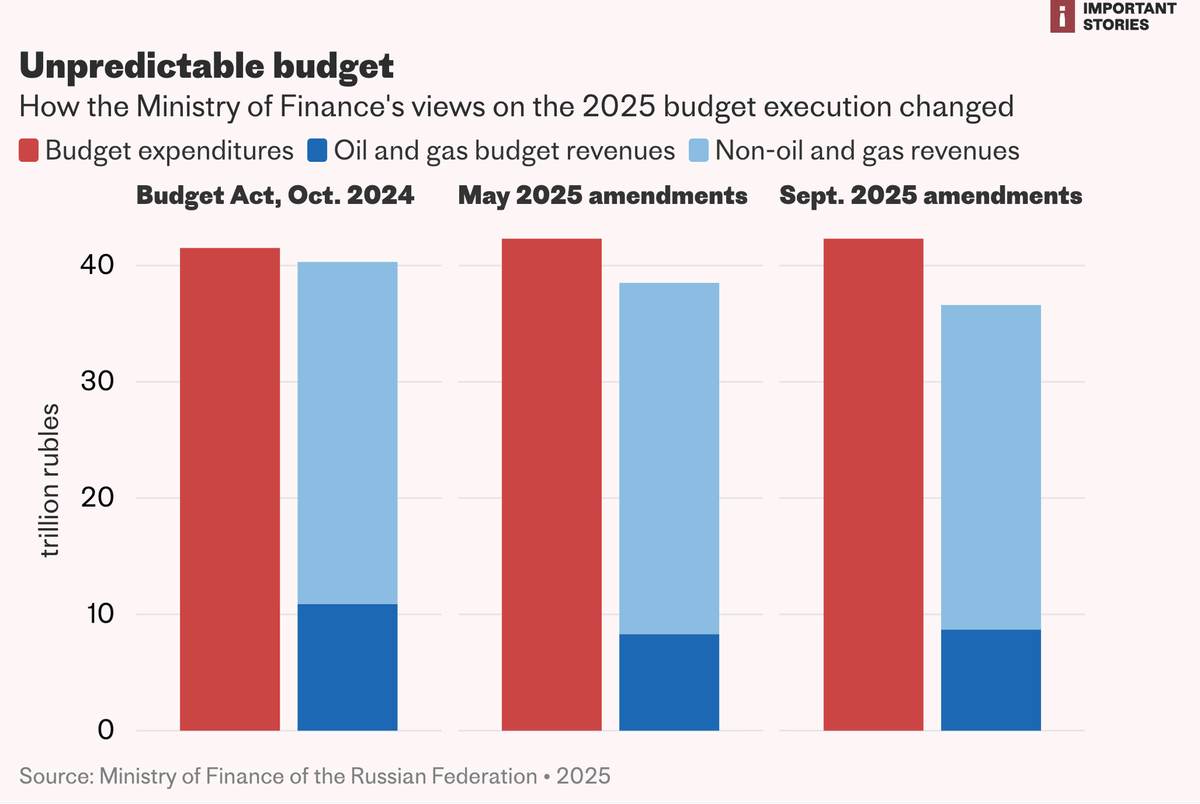

Misfortune struck when least expected. In 2024, the government managed to grow expenditures by almost a quarter (from 32.4 to 40.2 trillion rubles), but in 2025, it was barely able to increase spending by 2 trillion, reaching 42.3 trillion. What happened?

First, the oil prices dropped and the ruble got stronger. This collapsed oil and gas revenues: in April, the Ministry of Finance had to revise the budget, cutting these revenues by almost a quarter (2.6 trillion less).

At the same time, budget expenditures were not cut. Instead, they grew by 0.8 trillion rubles. The government figured that the non-oil and gas revenues would exceed last year's forecast. It may have been due to excessive optimism, or to understanding that -despite all talks - the war wouldn't end, and the spending would have to be increased. Either way, while revenues were shrinking, the planned spending was increased, and the budget deficit tripled.

Then the economic slowdown began to take its toll (IStories have reported on it). The government remained optimistic up to the last moment: when everyone was talking about the beginning of stagnation, it still predicted a 2.5% growth in 2025. Then this forecast was changed to just 1%. Note that the slower the growth, the lower the GDP (and the less tax revenue the budget receives). The forecast had to be changed again.

This time, the government slightly increased its estimate of oil and gas revenues, but reduced its forecast for other revenues by nearly 2 trillion rubles.

But there is no way to reduce the expenditures. They are all very important, Putin explained: in addition to the military ones, there are the social expenditures, which are considered “protected” and cannot be reduced. Infrastructure expenditures are necessary because we have to build roads and ports to deliver goods from the Far East, etc. It is also impossible to reduce spending on servicing the national debt, which will amount to 3.9 trillion rubles next year, or almost 9% of budget expenditures.

This led to a further rise of the 2025 budget deficit (up to 5.7 trillion rubles). And to a return to the pre-war budget policy framework.

The party is over

The authorities realized that such uncertainty is very dangerous. It became difficult to predict both revenues and expenditures (how much would be needed for the war). And there are fewer reserves to cover the budget deficit. There is only a third of pre-war funds left in the National Wealth Fund, and low debt is no panacea. The only way to borrow is from the state banks, but their capabilities are limited, and the interest rates are high.

But during the two pre-war decades, all of Putin's administrations were extremely cautious in their budget policies. They paid off foreign loans quickly and tried to avoid budget deficits to avoid being dependent on creditors. But while being careful with other expenditures, Putin is spending “ like a crazy man” on the war, not counting the money. Meanwhile, the 2026 budget indicates that the “war fever” is coming to an end: the government can no longer spend money as freely as it did in 2022–2025.

Budget expenditures are expected to total 44.1 trillion rubles, just 3% more than in 2025, a growth rate that is even lower than the inflation rate. The Ministry of Finance appears to have deliberately refrained from changing the spending figures in comparison with earlier plans: a year ago, in the draft budget for 2025-2027, it was estimated at 44 trillion rubles.

At the same time, revenue expectations are 8.6% up compared to the 2025 budget (37.1 trillion rubles vs 40.3 trillion rubles). To gather this much cash, the taxes are raised again (more on that later on).

The revenues actually may prove to be higher, as the budget is now based on a very cautious forecast. This is an old but reliable trick of the government. It translates as follows: if there is more revenue, there will be more to spend, and we will know what to spend it on. In general, it is much more pleasant to increase spending during the year than to cut it. Especially because it hasn't been easy to cut it.

This has almost always been done like this during the Putin era: the actual revenues usually exceeded the plan. The only exceptions were the crisis year of 2009 (when the GDP dropped by 7.9%, an unprecedented decline since the 1990s), the post-Crimea years of 2015-2016 (when oil prices also fell sharply), and the pandemic year of 2020.

Accepting the reality

This project is not just about accounting tricks. The basis for this cautious budgeting for 2026 is a cautious forecast by the Ministry of Economic Development, which is very close to most expert estimates (for example, the consensus forecast by the Higher School of Economics Development Center and the Central Bank's macroeconomic survey conducted among 33 analysts). For a long time, the Ministry had refused to acknowledge the stagnation, but it has now recognized the obvious.

The forecasts for economic growth and inflation have been lowered (the lower the growth, the worse consumer sentiment and the less opportunity producers have to raise prices). This is exactly what allowed the government to show that the budget revenue growth will not be too rapid despite the rise in taxes.

Nabiullina's budget message

Perhaps even such estimates are optimistic. The growth of the military economy is slowing down, while the civilian economy has already begun to decline. According to the government-affiliated CMACP analytical center's calculations, production in most civilian industries has been declining this year, with a 5.4% decrease since the beginning of the year and a 6.3% decrease over the past 12 months. The Ministry of Economic Development is forecasting a 0.5% drop in investment next year, which is a reduction in future growth.

This is largely a result of the high key rate. Heads of enterprises and state banks are calling for it to be lowered, as, in the words of Sberbank CEO German Gref, “we face all the problems that arise in the economy at the following stage.” According to other CMACF calculations, for the industry the shock of high interest rates is comparable to the shocks of the pandemic and the start of the war.

The Central Bank is keeping interest rates high in order to reduce the inflation caused by enormous budget expenditures. It was directly stated by Central Bank Chair Elvira Nabiullina that the more cautious the budget, the lower the key rate. She compared the budget and the borrowing to two communicating vessels: the larger the deficit, the more money the budget pours into the economy and so less money has to be created through borrowing. The Central Bank regulates this through the key rate.

The government itself, in fact, is interested in lowering it. Andrei Makarov, head of the State Duma's budget committee, has estimated that each percentage point of the key rate costs the budget 280 billion rubles a year, which is spent on servicing the national debt and subsidizing the interest rates on soft loans.

In general, the government had to show the Central Bank that it had not completely “lost its mind.” Nabiullina appreciated this sign of attention, calling the 2026 draft budget a “disinflationary” one.

Taxes for the war

All of this will be paid for by raising taxes. Maxim Reshetnikov, Economic Development Minister, stated that the alternative would look like an increase in the budget deficit along with high key rate and much slower economic growth during the three following years.

The choice made by the government shows just how huge the economic problems are. When the economy is teetering on the brink of recession, it is recommended to lower taxes rather than raise them in order to reduce the burden on businesses. It was even announced by Anton Siluanov at the end of June that there were no plans to change taxes. But the war is squeezing everything it can out of both the budget and the economy.

According to the Ministry of Finance's estimates, in 2026 the tax changes will bring in about 1.8 trillion rubles to the budget, which, according to the explanatory note in the document, will go “to finance defense and security.” In economist Dmitry Polevoy’s estimate, even more revenue will be collected: 2.4 to 2.9 trillion.

The main measure, which will provide the budget with at least 1.2 trillion rubles, is a VAT increase (from 20% now to 22%). This tax brings in almost 40% of the budget's revenue. Russians will have to chip in for the war by paying the state a bigger tax for every purchase.

In addition, the gambling business will be taxed more, and transport disposal fees will grow. It's also been suggested to quickly raise excise duties on “ unhealthy” consumer goods and introduce a new tax on imported goods trade (to combat smuggling).

In addition to raising taxes, many benefits are being abolished. Now, small businesses will be required to pay VAT when their income exceeds 10 million (compared to the current 60 million threshold, introduced a year earlier — before that, small businesses were not required to pay VAT at all). The pandemic-era tax break for IT companies will be reduced, and they will now have to pay insurance contributions on salaries up to 230,000 rubles per month at a rate of 15% instead of 7.6%.

Patriotism etc.

The reduction in military spending, however, may turn out to be just an accounting trick. The government may finance part of next year's spending in December 2025, just the way it did in the previous two years, suggests Sergei Aleksashenko, a Russian economist. And since the government has classified the structural budget execution data, we will not know how much will actually be spent on the war in 2025. This year's budget is hopelessly ruined by a record deficit anyway, but the future one still has a chance to “look beautiful,” Alexashenko argues.

The “beauty” lies in the fact that by suspending the increase in military spending, it has been possible to increase almost all “peaceful” sections of the budget. This contrasts sharply with previous years. In 2026, the biggest increases (apart from servicing the national debt and national security) are supposed to happen in the following sections: transfers to extrabudgetary funds (+13.2%), education (+10.1%), the state administration (+10%), housing and public utilities (+9.9%), the economy, and social policy (+9.4% each). Spending on healthcare is barely growing (+1.1%), as are transfers to regional budgets (+3.3%). Salaries for public sector employees are planned to increase by 7.6%, roughly in line with inflation.

High interest rates have led to increased spending on servicing the national debt. In 2026, it will reach 8.8% of budget expenditures (in 2021, it was half as much, 4.4%). Starting 2025, the Ministry of Finance almost stopped spending the money from the National Welfare Fund and is financing the entire budget deficit solely through debt. According to the ministry's plan, the state debt will double between 2024 and 2028.

Nevertheless, some expenditures will have to be reduced. In 2026, among the outsiders are the aviation industry (a one-third reduction in expenditures), agriculture and rural development (24-30% reduction), the “Long and Active Life” national project (by 27%), public health centers modernisation (by half) and emergency medical services (by a quarter), rehabilitation programs (almost threefold), regional and local road networks (by 10%), and the state support for exports (by half). The “Domestic Solutions” project (support for the IT shphere) has been reduced by more than three times, and funding for the state energy development program by 22%. The “Workforce” national program financing has been reduced by the same amount, and a similar federal program, “Active Employment Promotion Measures,” has been cut by 20%. Indeed, what is there to promote when unemployment is already at its minimum?

Most of the budget expenditures are allocated to various state programs. Of the 51 state programs expenditures on 18 will decrease in 2026, and the total spending on the programs will fall by 13%, from 38 to 33.1 trillion rubles.

On the other hand, spending on the electronics and radio-electronics industry will increase 4.3 times, up to 186.5 billion rubles. However, little is known about these programs, as they are classified. Tourism development expenditures will increase by more than a third.

As always, the budget includes a lot of “ideological” expenditures as well as spending on propaganda and “youth education.”

The patriotic project operatorsAmong other things, the “Movement of the First” will receive 7.4 billion rubles for "patriotic education", another 9.6 billion for "educating the younger generation", and 1 more billion for promoting the movement. "Yunarmiya" will receive 1.1 billion for its "military-patriotic" events. The Russian Cultural Foundation will receive 1 billion rubles for “preserving and promoting traditional values,” and the Russian Military Historical Society will receive 524 million rubles to create war memorials, organize military history camps, and conduct patriotic educational programs.

The Presidential Fund for Cultural Initiatives will receive 1.2 billion rubles to support the “highly demanded cultural, educational, and historical projects.” 460 million rubles will be spent on the “national films” that “reinforce spiritual (religious) and moral values.” The Institute for Internet Development will receive 26 billion rubles to create state-controlled content that “strengthens civic identity as well as the spiritual and moral values mentioned above. The ”Russia, Land of Opportunity” NPO will receive 2.6 billion rubles for the “It’s in Our Blood” project, the “Time of Heroes” program, and the “Leaders of Russia” competition.

Spending on the “Russia in the World” project has more than doubled, from 5.5 to 11.9 billion rubles, including 5.1 billion rubles for sending abroad Russian language teachers and encouraging foreigners to learn Russian.

There is no longer any possibility to continue increasing military spending without serious consequences. To do so, it will be necessary to either raise taxes again or stop indexing other expenditures, just as it has recently been done in Turkmenistan where the head of the council of elders asked the Supreme Leader (on behalf of the people) to stop raising salaries, pensions, state benefits, and scholarships, as “the social and living conditions of the people now reached a high level” and they live “peaceful, prosperous, and happy lives”. He also asked the leader to direct the savings “toward the further development of the country and other important areas.”

Russia has not gotten to this point yet.